« back to moneycontrol

Empower your wealth with trading calls & cutting edge strategies DIRECTLY from Dr C K Narayan.

- Favourable trading opportunities in a day in stocks, stock futures and options, Index futures and options.

- A weekly report with detailed insights on the future market trends and trading opportunities for the week ahead.

24 March 2023

Friday

Despite the best intentions to head higher the higher levels attracted supplies thus inducing large scale volatility.

Despite the best intentions to head higher the higher levels attracted supplies thus inducing large scale volatility. The steady pressure emerging at higher levels have thus lead to weakness emerging across the board. As the sectors ended the week in red there is a widespread supply at higher levels are now posing a threat. The rebound seen recently only seems to be attracting more supply forcing us to navigate our path carefully.

There seems to be no consensus amongst the broader indices. With the trends remaining confused we need to adopt a discretionary approach as the trends are looking at global cues to decide the future course of action. Using a mean reversionary approach we have decided to our weekly recommendations to select the following stocks – JINDAL STEL, AUROPHARMA, MGL and APOLLO TYRES.

Product offering

Winning the market is creating the right combination of information, preparation and action.

Dr C K Narayan is an advisory that equips subscribers with right information, analysis, updates and recommendations to enable high returns.

top Trading Opportunities

C K Narayan will identify trading opportunities with prospect of high potential in stocks, stock futures and options, index futures and options. This service will also highlight profitable tradable situations in the Currency and Commodity markets. The trading calls and follow up calls will be rendered through SMS for timely action.

Follow up SMS may be sent if and when there is any change in the advised content of earlier messages. (The SMS will mention entry price range, stop loss levels and the expected target zones)

- Book Profit in NIFTY around 7510 Book profit in 1 lot and revise stop to cost for next

- Exit AXISBANK near 404

- BUY HINDUSTAN PETROLEUM CORP Jan 1 lot BTST near 883.50 with stoploss of 871.00 for a target of 898.00

- BUY BAJAJ AUTO LIMITED Jan 1 lot [Intraday] near 2378.00 with stoploss of 2360.00 for a target of 2405.00

- BUY TRIGYN TECH [Investment] near 103.70 with stoploss of 100.00 for a target of 110.00

- SELL NIITTECH [IntraCash] near 555.35 with stoploss of 561.00 for a target of 546.00

Top Trading Ideas

WEEKLY ROUNDUP REPORT

The weekly roundup report will provide detailed insights on the current and future market trends. It will outline the trading opportunities in the week ahead.

Newsletter Sections-content Snapshot

A typical newsletter from the Research Analyst - Mr. C.K. Narayan will contain the following

Market analysis: The index column will give a detailed outlook on Nifty and Nifty Futures and the broader market trend. It will detail the important technical levels that traders should pay attention to in the following week while keeping the larger perspective in view.

Stock watch: Stock Watch column analyses investment prospects in stocks, stock futures and options for the following week.

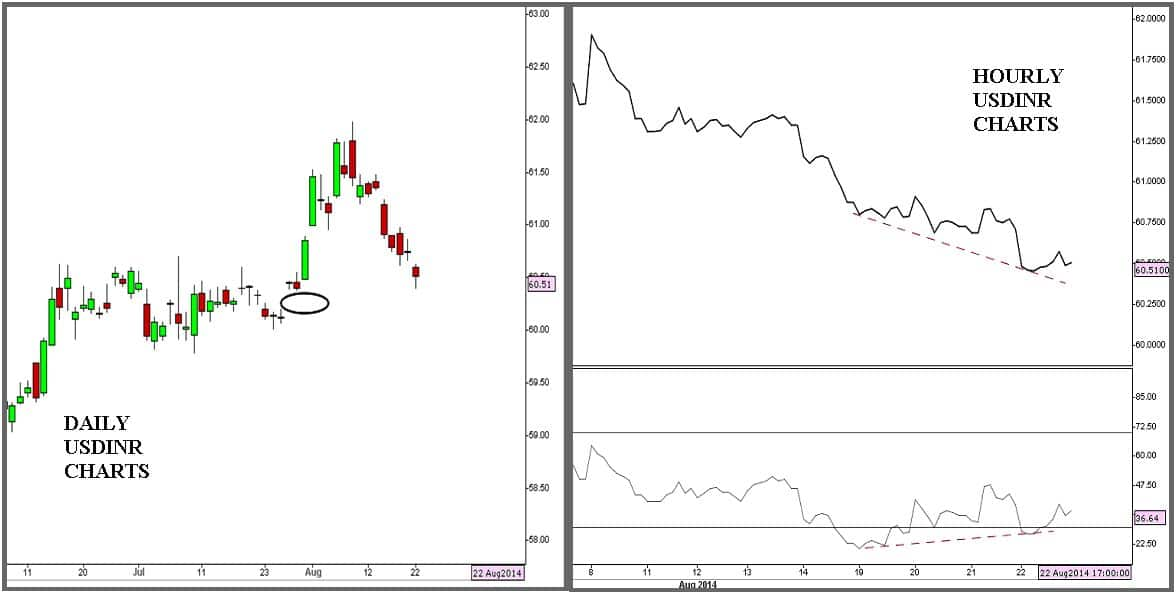

Commodity & Currency watch: This section will give you a perspective on global news and events that impact the commodity and currency markets and will identify trading opportunities within them.

To get access to mailers on a real time basis on you mobile, log on to http://m.moneycontrol.com/gamechangers/cknarayan

Why Subscribe ?

Dr C K Narayan empowers your investment decisions.

- Master Analyst Service: The service is brought to you by renowned stock market master analyst Dr C K Narayan, who has an impeccable track record of 40 years.

- Keeping you ahead:: The service keeps you abreast of market trends and identifies trading opportunities well in time, helps you stay on top of the game.

- Trade with confidence: The service will simplify the process of making money by doing all the groundwork to bring to you opportunities to trade that have high prospect. So all you need to do TRADE.

- Scientific analysis: The recommendations are backed by in-depth market intelligence, scientific analysis using globally proven methods and usage of cutting edge charting softwares.

- Comprehensive Service: It addresses the needs of every kind of market player- the day trader, the multi day trader, swing trader and the positional trader. It also caters to all the segments of the market - Equity, Derivatives, Commodity and Currency.

ABout Ck Narayan

Founder and CEO, Growth Avenues

His varied business experience from smallest retail client to large FII clients gives him unique insights into the workings of the market. His views are much sought after and he has been featured as an expert market commentator on television and print media. He has also trained thousands of technical analysts across the country.

In his analysis services, Dr C K Narayan uses a unique combination of simple trend following techniques as well as the complex world of Gann and Elliot wave methods in addition to using trading systems created from proprietary algorithms.

Brief note on how to interpret the Trading Calls »

Brief note on how to interpret the Mailer »

FULL REFUND TRIAL PERIOD