An investor while making an investment considers certain important aspects like return on investment (ROI), yearly accretion, tax impact at the time of liquidation, etc. In volatile markets, debt mutual fund has been the go-to investment for risk-averse individuals given the availability of indexation benefit.

Debt mutual funds are funds other than equity-oriented mutual funds. As per the Income-tax Act of 1961, an equity-oriented fund means a fund:

- where the investible funds are invested by way of equity shares in domestic companies to the extent of more than 65 percent of the total proceeds of such fund; and

- which has been set up under a scheme of a mutual fund.

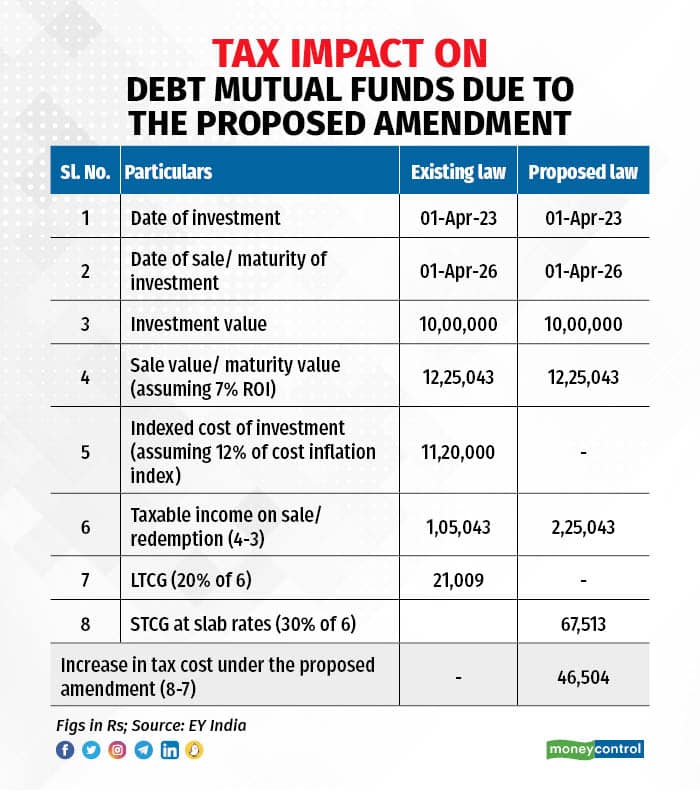

Under the current taxation methodology, debt mutual funds in India are taxed based on the period of holding. Debt mutual funds held for more than three years are classified as long-term capital assets (LTCA). The long-term capital gain (LTCG), or the redemption value less purchase value, is taxed at 20 percent with indexation benefits. Where the debt mutual fund is held for less than three years, the short-term capital gain (STCG) is taxed at the slab rate. Indexation allows investors to account for inflation in their gains by adjusting the purchase price in the year of sale, ultimately reducing their overall tax liability by using the cost inflation index.

Though the Budget did not tinker with the provisions relating to the taxability of non-equity-oriented funds, while moving the Finance Bill 2023 for approval on March 24, 2023, the Finance Minister introduced amendments to it. As per the amended Finance Bill 2023, investment in specified mutual funds (SMF) with effect from April 1, 2023 will be classified as short-term capital assets (STCA), irrespective of the period of holding, and the capital gains will be taxable based on the slab rate. An SMF is defined to include any mutual fund where not more than 35 percent of its total proceeds is invested in the equity shares of domestic companies. It is important for each investor now to review the asset allocation of mutual funds to ascertain whether such funds would be impacted by the proposed amendment. A few of the investment products which may be impacted are:

- Debt mutual fund: These are mutual fund schemes that invest in debt instruments like corporate and government bonds, corporate debt securities, money market instruments, etc.

- Gold mutual Fund: These mutual fund schemes invest in units of gold exchange-traded funds (ETFs)

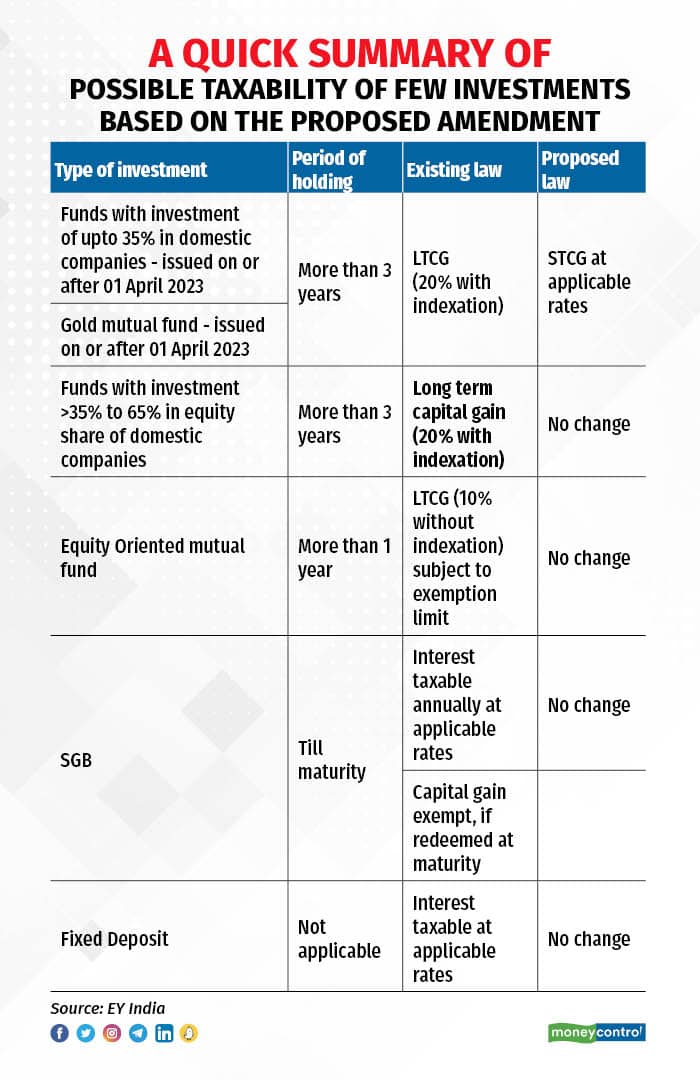

The indexation benefit and tax rules shall continue to be the same as it stands today for debt mutual funds purchased on or before March 31, 2023. This tax change now creates three categories of mutual funds:

- Funds with 0-35 percent investment in equity shares of domestic companies. Such funds will be impacted due to the proposed amendment and will be considered as STCA.

- Funds with investment >35 percent to 65 percent in equity share of domestic companies. Such funds will not be impacted due to the proposed amendment. Such funds will continue to be considered as LTCA (held for more than 3 years) and enjoy indexation benefits

- Funds with investment of >65 percent in equity share of domestic companies. Such funds will not be impacted due to the proposed amendment. Such funds will continue to be considered as LTCA (held for more than 1 year).

Considering certain judicial precedents (capital gains arising on depreciable assets), a view may be taken that the new provision merely modifies the method of computation of capital gain (indexation benefit denied) and does not change the long-term character of the asset for other purposes like a lower rate of tax on LTCG, etc. However, this is likely to be subjected to litigation and litigation-averse investors may prefer to pay tax at slab rates.

Shuddhasattwa Ghosh is Tax Partner, EY India. Views expressed are personal, and do not represent the stand of this publication.