The monthly figures released by regulator Directorate General of Civil Aviation (DGCA) for February show that Akasa Air has reached the 3 percent mark. The airline, which intended to induct 18 aircraft by the end of March, now has 19 in its fleet.

Every time Akasa Air is referred to, there is a comparison with IndiGo, for various reasons, including the leadership of Aditya Ghosh, who was part of the startup team at IndiGo and later became its president and whole time director; Ghosh is now with Akasa Air.

There are some other similarities as well. Both airlines had their first flight in August — IndiGo started operations on August 4, 2006, while Akasa Air started operations on August 7, 2022.

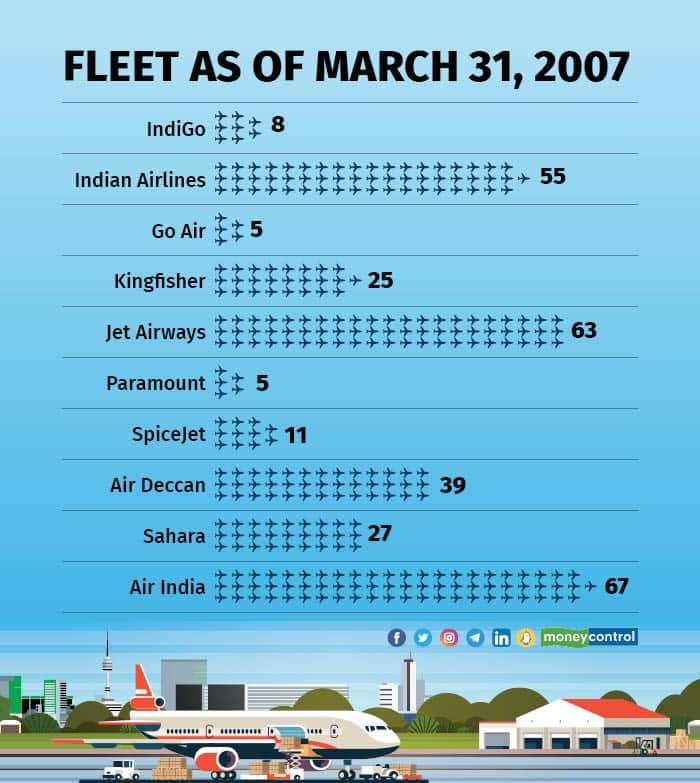

Fleet as of March 31, 2007

Fleet as of March 31, 2007

More planes for the same market share

To reiterate, Akasa Air recorded a market share of 3 percent in February and will see a slight jump when it closes in March. The airline has 19 aircraft in its fleet as of now. In comparison, IndiGo ended its first financial year with 8 A320neo aircraft and a market share of 2.6 percent.

However, the market has changed by leaps and bounds. What needed eight planes to gain 2.6 percent now needs 18. A market that had 305 commercial aircraft in March 2007 has a little over 700 right now.

The comparison from 2006-07 to this year also tells the story of IndiGo’s resilient growth. Back then, the industry operated 1,153 domestic departures per day on an average, a number that IndiGo alone surpasses on a daily basis today. The airline operates to over 75 domestic destinations and over 100 total destinations across the world.

Akasa Air will take time to cruise

Each airplane induction by Akasa Air comes with its own challenges because IndiGo operated just half the stations compared to Akasa Air when it started out. Market share is one area but a thin presence across the country is another.

The other areas where Akasa Air has had to take a backseat is in standardisation. LCCs, at least in their initial days, focus heavily on standardisation, which helps have limited and controlled inventory of spares. Akasa Air operates planes with three seats / colors, in one case having to deploy a business class product.

This is because Boeing was sitting on a lot of white tails — ready-to-fly planes not taken up by the airlines that had ordered them. In normal times, the new airline would change the interiors to its livery; but supply chain constraints have meant that new seats are not available at the rate at which they are in demand. The much touted USB charging ports, thus, are not part of all planes and thus not part of the airline’s marketing strategy.

In India, though, what matters the most is the input cost, since airlines have not been able to raise fares to healthy levels for years. In such a scenario, Akasa Air is believed to have got a deal like no other as Boeing wanted to make inroads into the Indian market, which is dominated by rival Airbus. Holistically, the seat mismatch is temporary while the cost advantage is permanent.

Also Read: Akasa Air sees no shortfall of pilots in India as it pursues expansion

The market has changed

Since March 2007, Indian Airlines has merged with Air India and today is a private entity, Kingfisher Airlines went down in 2012, after having merged with Air Deccan; Jet Airways bought out Air Sahara and went down in 2019. Paramount, too, went down, leaving IndiGo, SpiceJet, Go FIRST (Go Air back then) and Indian Airlines (now Air India) as the carriers that have sustained.

Until 2016, till the National Civil Aviation Policy (NCAP) came into being, airlines had to wait for five years and have 20 aircraft in their fleet to fly internationally. The rules have since changed for airlines to start flying internationally, with 20 aircraft as the minimum, and no restrictions on years of operations.

The market has also shifted, with IndiGo alone cornering over half of it today; in 2006-07 it was fragmented among Jet Airways (31%), Air Deccan (18.58%) and Indian Airlines (17.37%).

All eyes will now be on Akasa Air’s international operations as it will be the first airline to truly take advantage of the 0/20 rule.