The health insurance space in India seems to have hit the refresh button.

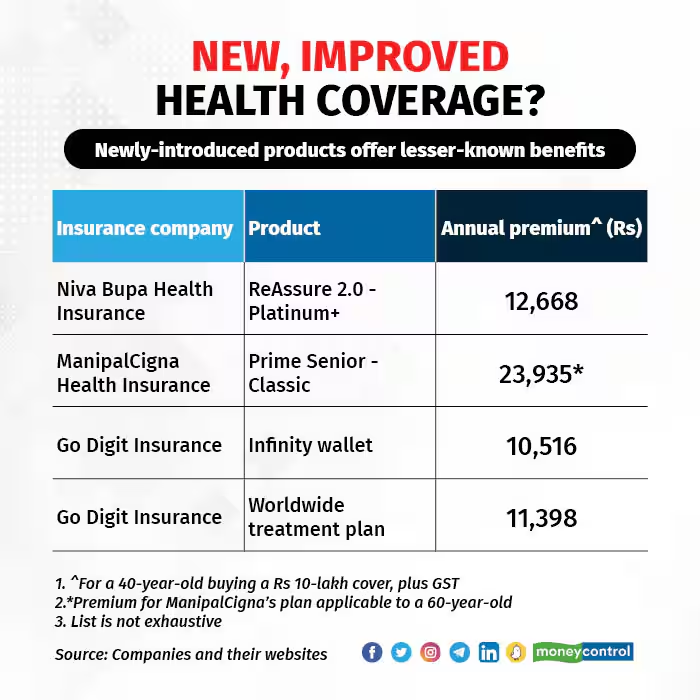

A clutch of insurance companies such as Bajaj Allianz General Insurance, Niva Bupa, ManipalCigna and Go Digit have, in the last few months, announced products with newer benefits. “The insurance regulator last year allowed insurers to launch products in the use-and-file mode. In the last 4-5 months, several companies have come up with innovative offerings. Value-added-services offered have increased,” says Vivek Chaturvedi, Chief Marketing Officer and Head of Direct Sales, Go Digit General Insurance.

Also read | Moneycontrol SecureNow Health Insurance Ratings: How to pick the right policy

Here’s a look at some of these features.

Higher sum insured for not making claims, restoration features

Simply put, a cumulative bonus enhances the sum assured chosen by the policyholder without increasing the premiums. So you get higher coverage at no extra cost. Now, insurance companies are taking this offering several notches higher.

For instance, Niva Bupa’s ReAssure 2.0 allows the policyholder to carry forward any unutilised base sum insured to the next policy year. The maximum accumulated sum insured can go up to five or ten times the base sum insured. “The sum insured amount will keep on accumulating with each renewal till up to 5X and 10X, depending on whether the customer has opted for platinum+ or titanium+ variant,” the company said in a media release.

Digit Insurance’s Infinity wallet plan will provide back-up sum assured – triggered when the existing sum assured is exhausted due to claims– infinite times in a year. However, any single claim cannot exceed the policy's sum insured.

Double wallet plan, as the name suggests, doubles the sum insured in case it is exhausted due to a claim. “Health costs have gone up and claim severity has increased drastically post COVID. So, a sum insured of Rs 3-5 lakh will not be sufficient. So reloading of sum insured option allows them to access larger cover without an increase in premiums,” says Chaturvedi.

Also read: A health insurance policy that locks your premiums till you make a claim

Premium at entry age bracket locked in until first claim

Standalone health insurance company Niva Bupa introduced ReAssure 2.0, a health insurance product with a ‘Lock the clock’ feature, where renewal premiums get linked to entry age and claim-free period.

Health insurance customers’ renewal premium hikes are linked to insurance companies’ claim experience, healthcare inflation and age band. However, because of the product’s feature, the age at which the consumer enters the policy gets locked until she makes her first claim.

For example, if you buy the policy at the age of 30 years, the annual premium applicable to this age band will continue until you make your first claim. So if you make your first claim at the age of 40, you would have the premium applicable to a 30-year-old for ten years. Once you make the claim, the renewal premium applicable then to your age bracket will apply.

Covers for senior citizens

Last year, Bajaj Allianz General Insurance unveiled a host of value-added services for senior citizens. To be purchased as a rider benefit, the cover is termed Respect - Senior Care rider. The product’s variants offer services such as home assistance, physiotherapy, nursing care at home, ambulance services and tele-consultations, with the premium variant offering a smartwatch with fall detection technology, among other things.

Standalone health insurer ManipalCigna in January rolled out a product for senior citizens which has done away with room rent sub-limits, co-pay and pre-existing disease waiting period clauses. “The new plan is designed after considering the various problems that people face in the golden years of their life. They may have suffered from medical complications earlier or may have an income problem as most of them are living on their retirement funds,” said Prasun Sikdar, MD and CEO, ManipalCigna Health Insurance at the time of launch.

Also read | ManipalCigna rolls out senior citizens' health plan without sub-limits, co-pay

Diabetes no bar

Living with diabetes is not an automatic disqualifier for obtaining a health insurance policy, with companies like Star Health and Aditya Birla Health offering dedicated covers for diabetics. However, issuing the policy is the insurer’s call. Niva Bupa now offers a cover specifically for diabetics.

According to Bhabatosh Mishra, Director, Underwriting and Products, Niva Bupa, even applicants with HbA1C (average blood sugar) as high as 8, which indicates moderate control, can hope to get the policy, provided they have not developed complications such as diabetic neuropathy, kidney disease and so on already.

Worldwide coverage

In the recent months, Go Digit Insurance, Reliance General Insurance and Bajaj Allianz have announced products that also cover planned treatment abroad. “Regular covers do not pay for planned treatment abroad. Under Digit’s plan, if someone wants to visit the US for cancer treatment, the policy will reimburse the expenses,” says Chaturvedi.