Traders always follow trends and consensus. Placing a trade so that the entry is right after the emergence of a trend and the exit right before the end of the trend is vital.

Each one of us has our own system that indicates such trade set-ups. What I mean is we have our systems that define the entry and exit points, however, Options Open Interest data can help us give an edge over our existing systems.

What is Open Interest?

Open Interest (OI) is the accountability of any derivatives contract, including options. Since there are no physical shares backing these futures and options, every buyer and seller creating a contract gets recognised as one Open Interest.

Some features of Open Interest:

>> Creating OI requires a buyer and a seller

>> More OI, more interest in the derivatives instrument (more important it is)

>> Options OI is usually more in higher calls and lower puts

>> Options OI is determined by the number of sellers in the option

Now, to the part where we can use this data to sharpen the trade. Before getting there, let me explain the last point.

As we all know that an options buyer has an unlimited profit profile and a limited loss profile. An options seller has an exactly opposite profit-loss profile.

Sounds familiar?

Yes, an insurance seller pays us Rs 10,00,000 for a tiny Rs 10,000 premium. So, just like option sellers, insurance companies sell life options and have a big loss profile than a profit profile.

The reason for bringing this up is that the amount of insurance available predominantly depends on how much insurance companies want to sell. Similarly, options OI is dependent on option sellers.

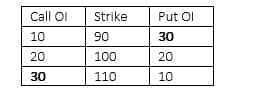

Back to sharpening the trades. Let us understand this with an example. Suppose there are 3 strikes—Rs 100, Rs 110, Rs 90—and the stock is trading at Rs 100 OI on the strikes is as follows.

As explained, a higher Call and lower Put have a higher OI. This means the option sellers are betting against a move above Rs 110 and Rs 90.

That is one way of sharpening the trade.

If your trading model is expecting a target price of Rs 115 in this expiry, well think again. These highest OI strikes in Call and Put act as a stiff hurdle. Data suggests that these heavy strikes are very tough to break. So, that is one sharpening, since we now have good visibility into what the market consensus is expecting.

The second sharpening is the breach of such data. Not all market consensus is always right. These levels do not get broken often but they do get broken. Again, referring to past data and my own personal experience.

When the highest OI Call and the highest OI Put strike end up getting broken, the stock moves really fast in the direction of the break.

For example, if the stock mentioned above sustains above Rs 110 for a few sessions, it is likely that it may run up by a few percentage points in a brief time. I have used this as one of the supporting arguments in many of my trades.

So, there we go. Look at the highest OI strike on Call and Put and you may have a lot of profitable information to sharpen your trade. Data of Call and Put OI is available on the NSE website in the Option Chain as well as in some of the options analytics apps for free.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.