The Nifty ended in the positive on March 27 after two days of loss, though it closed much lower than the intraday high. At close, the index was up 41 points at 16,986, however, broader market indices ended in the negative as the advance decline ratio fell to 0.3:1.

Primary and intermediate trend remains weak as the Nifty trades below its 100 and 200-day EMA (exponential moving average). Weekly momentum readings like the 14-week RSI too are in the decline, indicating the bears are in control.

In the last 10 trading sessions, the Nifty found resistance in the range of 17,200-17,225 multiple times. This level coincides with the 20-day EMA which is placed around 17,235 level. Therefore, the short-term trend will remain bearish till the Nifty closes above the 17,235 levels.

Among the Nifty options, Puts are being written off at 16,800-16,900. FIIs long to short ratio in the Index Future is placed at an oversold levels of 0.15 which in-turn indicates there is a higher probability of short covering by them from hereon. Therefore, on the downside, 16,800 could now be considered as an immediate support for the Nifty below which it could accelerate its move on the downside.

On the upside, 17,235 could act as an immediate resistance for the Nifty. We may see upside momentum only if it manages to surpass 17,235 convincingly. Above 17,235, Nifty could move towards next resistance level of 17,324 and 17,530.

Broader market indices like the Nifty Midcap and the Smallcap underperformed with losses of 0.5 percent and 1.60 percent. In the process, both theses indices have broken down from a six-month trading range. They also continued to make lower tops and lower bottoms over the last several weeks and have witnessed a negative moving average crossover as the 20-day SMA (simple moving average) has moved below the 50-day SMA.

Here are three buy calls for next 3-4 weeks:

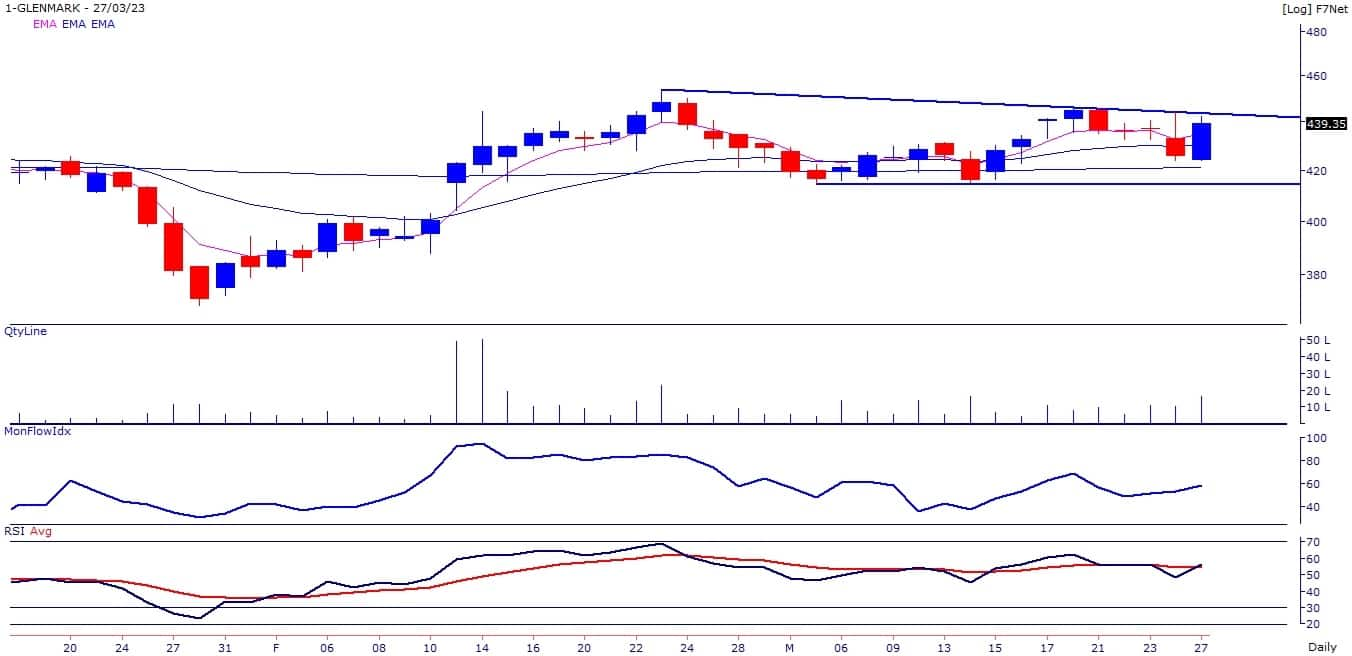

Glenmark Pharmaceuticals: Buy | LTP: Rs 439 | Stop-Loss: Rs 420 | Target: Rs 462-480 | Return: 9 percent

Short term trend of the stock is positive as stock price is placed above its 5, 11 and 20-day EMA. During the month of March, the stock price has formed strong base around 200-day EMA.

Stock price is on the verge of breaking out from the downward sloping trendline, adjoining the highs of February 23, 2023 and March 20, 2023. Momentum indicators and oscillators are showing strength in the stock.

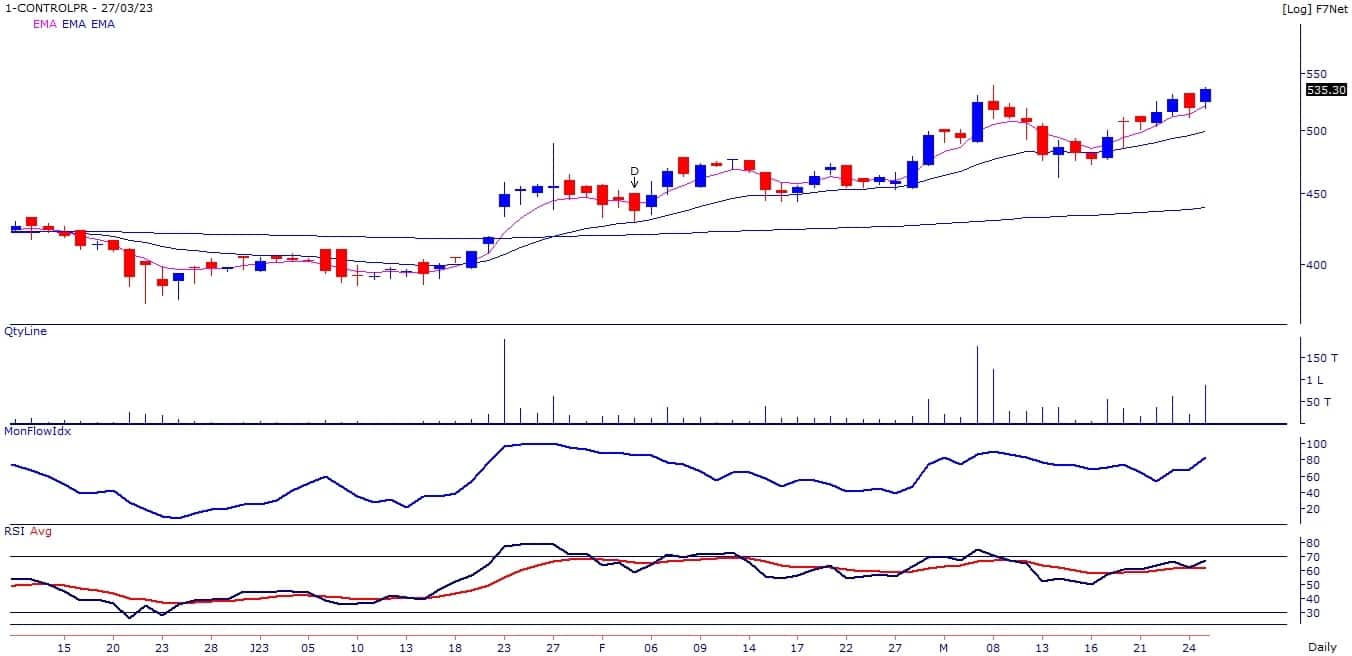

Control Print: Buy | LTP: Rs 535 | Stop-Loss: Rs 500 | Target: Rs 570-590 | Return: 10 percent

The stock price has broken out on the daily chart where it closes at highest level since January 2018. Stock price has already broken out on the weekly chart from the downward sloping trendline, adjoining the weekly highs of August 26, 2022 and January 27, -Jan-2023.

Momentum Oscillators - RSI (11) and MFI (money flow index - 10) is sloping upwards and placed above 60 on the weekly chart, indicating strength in the stock.

Rail Vikas Nigam: Buy | LTP: Rs 66.50 | Stop-Loss: Rs 62 | Target: Rs 71-74 | Return: 11 percent

The stock price broke out on the daily chart with higher volumes where it closes at highest level since March 10, 2023. Short term trend of the stock turned positive as stock price closed above its 5 and 20-day EMA.

Primary trend remains positive as stock price is trading above its 200-day EMA. Momentum indicators and oscillators are showing strength in the stock.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.