How do arbitrage funds differ from liquid funds?

Mar 27, 03:03

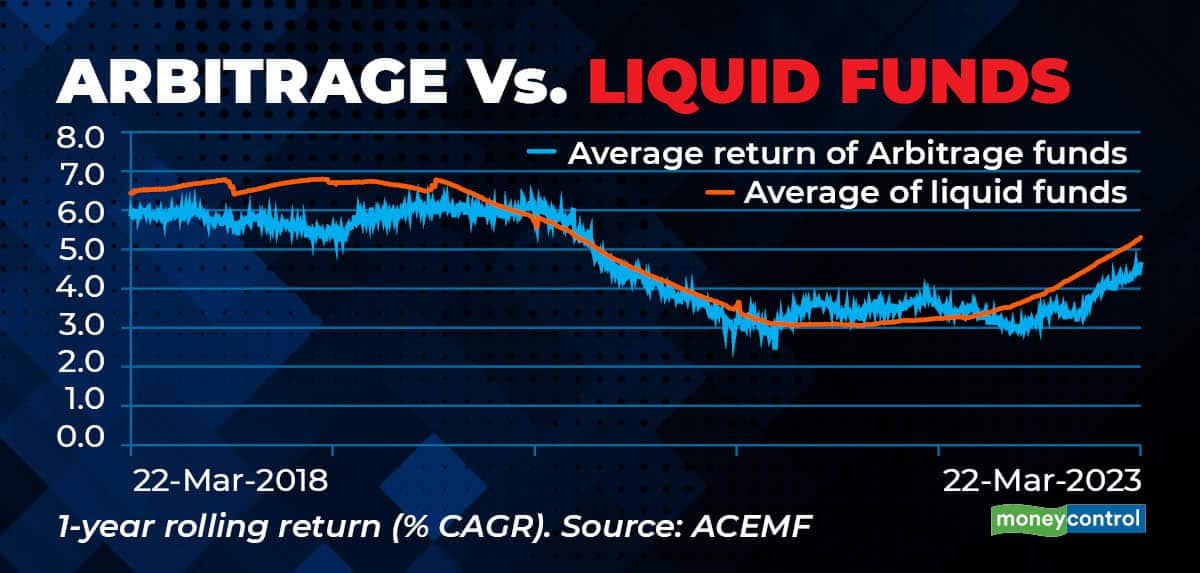

Both arbitrage and liquid funds came back in limelight lately. Both are suitable for short-term investments serving different purposes. Liquid funds do good in rising rates when there is a limited liquidity while arbitrage funds perform well when equity market see heightened volatility. Arbitrage funds score over liquid funds on taxation. Investments held in arbitrage funds within a year attract short term capital gain tax (STCG) of 15% on gain, while the STCG in liquid funds is applicable upto 3 years wherein the gain is taxed as per the tax slab. However, liquid funds look attractive at this scenario thanks to the predictable short-term rates which are traded at high.