The amendment to the Finance Bill, 2023, which was passed in Lok Sabha on March 24, closes the gates on one of the most-cherished benefits of debt fund investors -- indexation benefit.

This benefit was so far available to unit holders of debt funds on their long-term capital gains (LTCG) tax, if they stay invested for at least three years.

Now that the Finance Bill has removed LTCG benefits, the indexation benefits will also go.

The Bill will now be tabled in Rajya Sabha. It would then require the President's nod to become an Act.

What is indexation?

Indexation helps bring down taxes as it calculates them after accounting for inflation.

Current tax laws allow an assessee (a debt fund investor, in this case) to take into account the indexed cost of acquisition while calculating his/her LTCG tax liability.

For instance, if you buy an item for Rs 10 today, it will be worth a bit more, a few years down the line. Indexed cost of inflation takes into account annual inflation, and a formula is accordingly calculated to lift your cost price up.

In other words, indexation helps to adjust the investment amount against the Cost Inflation Index (CII) value of the financial year of purchase and sale, thereby reducing the tax burden on investors.

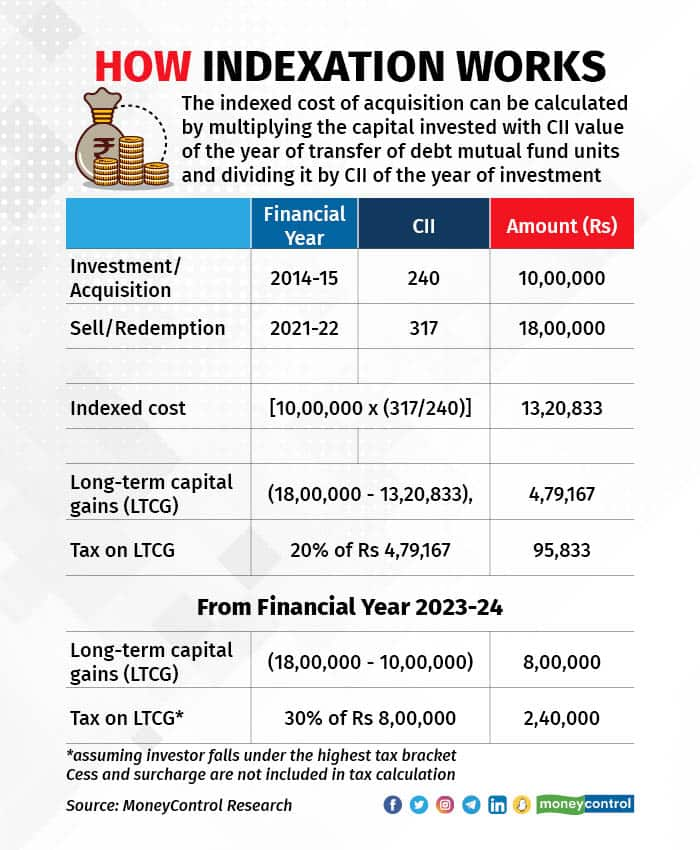

The indexed cost of acquisition can be calculated by multiplying the capital invested with the CII value of the year of transfer of debt mutual fund units and dividing it by the CII of the year of investment.

For example, if you invested Rs 10 lakh in a debt mutual fund in 2014-15 and redeemed it for Rs 18 lakh in 2021-22, the indexed cost of acquisition would be Rs 13,20,833 [10,00,000 x (317/240)]. Accordingly, your LTCG would be Rs 4,79,167 (18,00,000 - 13,20,833), which is the amount on which LTCG tax is applied at the rate of 20 percent.

Also read: Not just debt funds – gold and international funds to also lose from Finance Bill amendment

What is CII value?

CII values are used to calculate the inflation-adjusted cost of acquisition of assets like real estate, gold, debt funds, etc., while calculating the LTCG from such assets. The CII artificially increases cost price, reducing the difference between the sale and cost prices, which brings down the tax liability. This is how investors in debt funds had benefited so far. To be sure, indexation benefits were not available for equity mutual fund investors.

The March 24 amendment to the Finance Bill 2023 has removed the tax arbitrage.

“The amendment to treat gains on debt mutual funds as short-term gains will substantially diminish the attractiveness of such products,” says Punit Shah, Partner, Dhruva Advisors. This now brings debt mutual funds on par with other debt instruments like fixed deposits as far as taxation is concerned, going forward.

Tapati Ghose, Partner at Deloitte India explains, "At present, capital gains arising from transfer of mutual fund units, other than equity-oriented funds which are held for more than three years are considered as long term and are taxed at 20 percent with indexation benefit.”

“The amendment to the Finance Bill, 2023, has proposed to treat gains from the transfer of units of specified mutual funds as short term and tax at slab rates. This is in addition to the taxation of market-linked debentures proposed in the original bill," he said.

Ghose further elaborates that "specified mutual funds have been defined to include funds in which not more than 35 percent of the proceeds is invested in the shares of domestic companies. This may include debt mutual funds, gold ETFs, etc., in which investment in domestic companies is less than 35 percent of proceeds of the fund."

The new rule will bring an end to the indexation benefit that debt mutual funds were enjoying over fixed deposits and attracting investors.

As Ghose points out, "the proposed move seems to bring taxation of such mutual funds on par with bank deposits, which are taxed at slab rates. While the proposed amendment shall impact the transfer of the units of specified mutual funds acquired on or after April 1, 2023, the grandfathering benefit is not available for market-linked debentures."