That capital expenditure (capex) recovery spurs economic growth is a truism. Within capex, infrastructure spending is closely watched, especially in developing economies, because of its higher share of total spending, the significant role of the government in that spending, and the multiplier effect on gross domestic product (GDP) growth. It’s time for India Inc to pitch in.

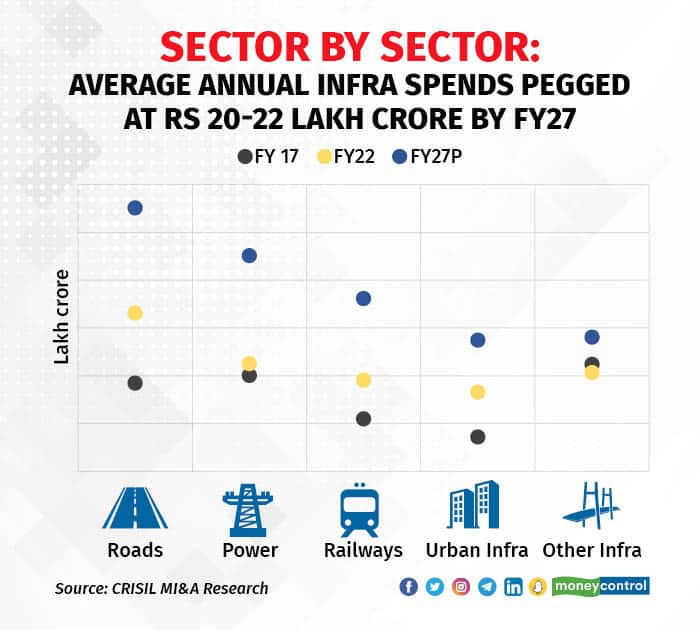

A strong corporate earnings cycle over the past 3-4 fiscals has led to material improvement in the credit profiles of companies, particularly the larger ones. They now need to back up government spending in infrastructure for sustained and healthy earnings and GDP growth. In fiscal 2022, the government accounted for a stupendous ~85 percent of the total spending of ~Rs 11.2 lakh crore in 10 key infrastructure segments. The private sector contributed the rest. Now compare that with industrial capex, where the share of the private sector is already 60-65 percent (a CRISIL Market Intelligence & Analytics study showed Rs 3.5-4 lakh crore industrial investments in fiscal 2022 across 15 sectors).

Showing The Way

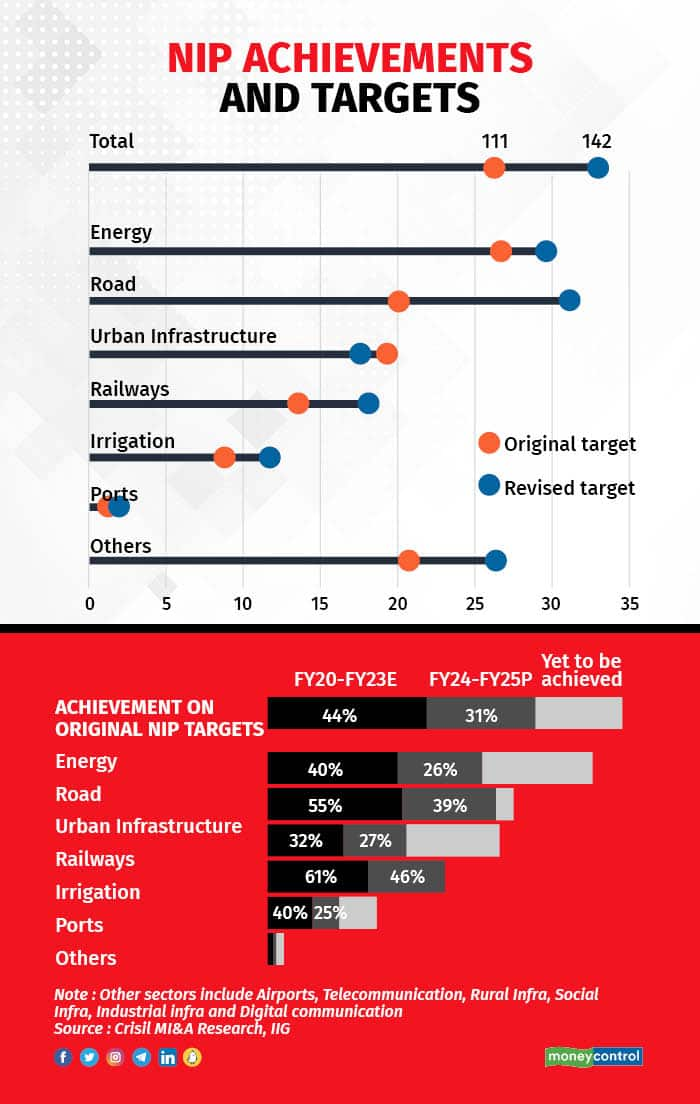

While the low share of private sector investments could be because infrastructure is generally considered a public good that should be affordable to, and accessible by, all, we expect the share of private sector in this vital area to rise from ~15 percent now to 25-30 percent by fiscal 2027. In large part, the increase in infrastructure investments will be owing to the government’s big push. Its flagship National Infrastructure Pipeline (NIP) is set to achieve ~75 percent of its Rs 111 lakh crore target by fiscal 2025. A chunk of this target is tied to four verticals — roads, railways, power, and urban infrastructure.

In terms of share of private sector investments in each of these verticals, roads have sped past others. Over the past five years, gaining popularity of the hybrid annuity model has enabled the share of private sector road developers to crawl back to 12 percent in fiscal 2022 from nearly negligible levels in fiscal 2016. Changes by the government to the model concession agreement to factor in changes in interest rates and raw material cost, scope of work redesign on delays, better payment timelines, and more skin in the game (by the government) have enabled the sector to recover from the failures of the build-operate-transfer, or BOT, biddings of 2010-11.

Clean Energy Transitions

Power comes next, with a major transformation in the offing. Energy transition targets under COP26 are firing up large renewable energy capacities in the country — predominantly solar, wind and hydro. We expect 142 GW of capacities to come up between fiscals 2023 and 2030, a growth of 2.2x over the past seven fiscals. Further, investment in areas such as smart meters and transmission are also expected to rise more than 20 percent to 4.3 trillion between fiscals 2023 and 2027.

In thermal energy, capacity additions that were predominant in the past few years are set to abate. Also, while the fixed-return model did not find many takers on the thermal side, the reverse bidding mechanism has led to healthy private participation in the renewable energy sector. The private sector already accounts for over 40 percent of the investments in renewables. Lower capex outflow versus thermal has also encouraged private participation in this segment.

Difficult Terrain

While railways and urban infrastructure spending remain mainly engineering, procurement and construction-based, even those in segments such as metro projects (within urban infrastructure) are unable to attract high private participation.

Given the current pace, it is reasonable to expect the share of private investments in the 10 key infrastructure segments to rise from ~15 percent as of fiscal 2022 to 25-30 percent by fiscal 2027 — a near doubling. There is a caveat, though. This needs the government to stay the course on policy reforms, transparency, agility and proactiveness that it has embarked on in order to sort out legacy issues such as payment and execution delays. For instance, over 800 of the 1,400 projects under the NIP are behind schedule. Also, in sectors such as power which account for a substantial proportion of the total incremental spending, monitoring the implementation of reforms will be important.

Particularly, the Revamped Distribution Scheme (RDSS) on discom effectiveness is imperative for payment discipline and profitability of renewable energy companies. In addition, across all sectors, asset monetization is progressing at a slow pace. Encouraging that in fast-growing segments such as roads, power and railways is essential to close the financing gaps. Ultimately, it is a swing in private infrastructure investment that will signify a turning point in India’s growth story, helping it surpass the 6 percent annual GDP growth rate average of the past decade.

Suresh Krishnamurthy is Senior Director, CRISIL Market Intelligence and Analytics. Views are personal, and do not represent the stand of this publication.