The Securities and Exchange Board of India (Sebi) has extended the last date for furnishing nominations for mutual fund investments from March 31 to September 30.

The capital market regulator had in June 2022 mandated nominations or opting out of nominations for all the existing individuals holding mutual fund units either solely or jointly by March 31, 2023, failing which the folios would be frozen for debits.

“Based on representations received from the market participants, it has been decided that the provision… with regard to freezing of folios, shall come into force with effect from September 30, 2023 instead of March 31, 2023,” the regulator said in its latest circular.

Sebi has asked Asset Management Companies (AMCs) and Registrar and Transfer Agents (RTAs) to encourage the unitholders to fulfil the requirement for nomination/ opting out of nomination by sending a communication on fortnightly basis by way of emails and SMS to all such unitholders who are not in compliance with the requirement of nomination.

Also read | March 31 deadline for MF nomination gives headache to investors

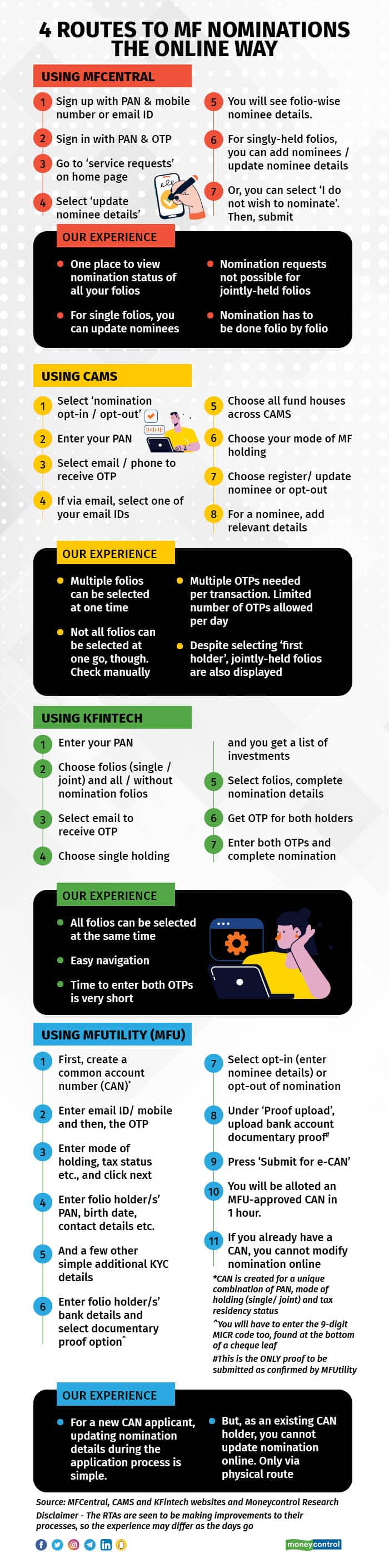

The regulator has specified the format for effecting nomination as well as opting out. The mutual fund houses have been directed to offer online as well as offline (physical) facilities to the mutual fund investors to either submit their nomination requests or to declare their intention to opt out of the nomination.

The investors can submit their nominations by filling up the form and submitting it to the fund houses or the registrar and transfer agents. The investors who are keen to opt out of the nomination have to do so by following the same process by using the specified format.

Also read | MC30: The best mutual funds to invest in

All existing mutual fund folios held in a single name or jointly need to have a nominee or an explicit opting-out declaration.

Mutual fund folios without nomination or an opting-out declaration will be frozen and investors cannot sell their units in such folios.