The market continued to see rangebound action for yet another session and closed the day with moderate gains amid choppy trade on March 28. Traders may be maintaining caution ahead of expiry of March derivative contracts scheduled on March 29, a day before the normal expiry day due to holiday on March 30, Thursday for Ram Navami.

The BSE Sensex declined 40 points to 57,614, while the Nifty50 settled the session with 34 points losses at 16,952 after trading largely in a range of about 60 points for major part of session and taking support at 16,900 and getting resistance at 17,100 levels.

The index has formed bearish candle or Inside Bar as it traded within the previous day's range, on the daily timeframe.

"Currently, the Nifty is repeatedly hitting the support of 16,900-16,850 levels and showing lack of strength to sustain the intraday upside bounces. The doji pattern of Monday has not impacted positively for the market in the next session," Nagaraj Shetti, Technical Research Analyst at HDFC Securities said.

He feels if the Nifty fails to regain strength to move up from the support in the short term, then that action could eventually result in a decisive downside breakout of the support band of 16,900-16,800 levels in the near term. Any upside bounce from here could find strong resistance around 17,100 levels, he said.

The selling pressure sustained in the Nifty Midcap 100 and Smallcap 100 indices which corrected 0.35 percent and 0.9 percent respectively on weak breadth. About three shares declined for every rising share on the NSE.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks in this article are the aggregates of three-month data and not just the current month.

Key support and resistance levels on Nifty

The pivot charts indicated that the Nifty may get support at 16,919, followed by 16,884 and 16,828, whereas if the index advances, 17,032 is the initial key resistance levels to watch out, followed by 17,067 and 17,124.

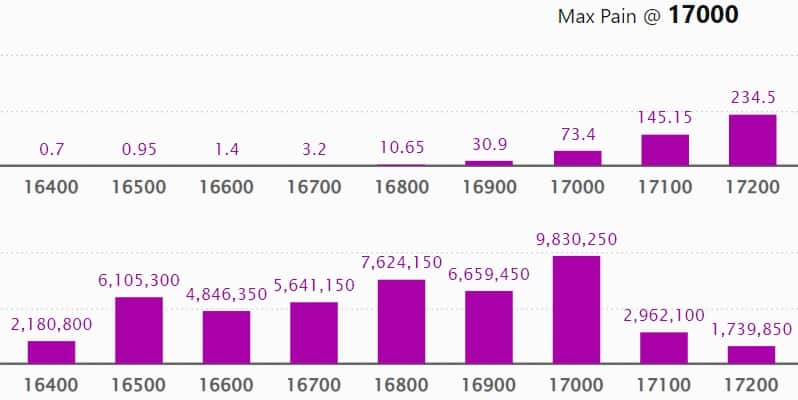

The Bank Nifty has performed better than broader markets due to uptrend in IndusInd Bank, ICICI Bank, and HDFC Bank. The index climbed 137 points to 39,568, extending northward journey for yet another session, but has formed Doji or Inside Bar kind of pattern on the daily timeframe.

Overall, the fight between the bears and the bulls continued in the Bank Nifty index ahead of the monthly expiry. "The index is stuck in a broad range between 39,000-40,000 where a significant amount of Call and Put writing is visible on the monthly expiry. The index once breaks out of this range will witness a directional move," Kunal Shah, Senior Technical & Derivatives Analyst at LKP Securities said.

Bank Nifty, as per pivot charts, may take an important support 39,391, followed by 39,316 and 39,194. However, key resistance levels are expected to be 39,635, then 39,710, and 39,832.

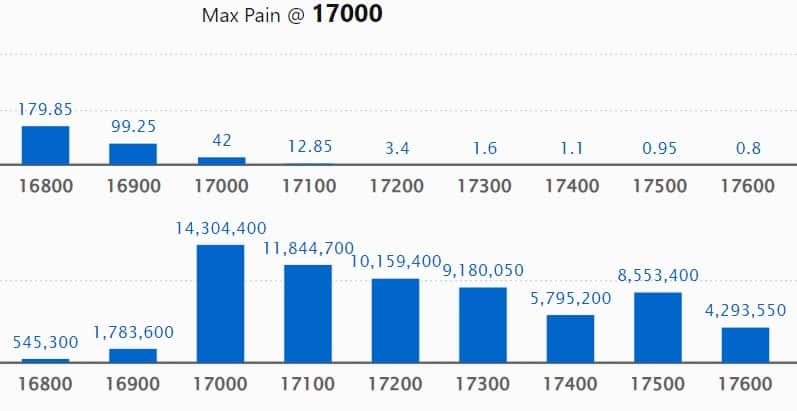

We have seen the maximum Call open interest (OI) at 17,000 strike, with 1.43 crore contracts, which is expected to be a crucial level for the Nifty in the coming session.

This is followed by a 17,100 strike, comprising 1.18 crore contracts, and a 18,000 strike, where there are more than 1.03 crore contracts.

Call writing was seen at 17,000 strike, which added 38.85 lakh contracts, followed by 17,100 strike, which added 30.14 lakh contracts and 17,200 strike, which accumulated 17.96 lakh contracts.

We have seen Call unwinding at 18,000 strike, which shed 26.36 lakh contracts, followed by 17,600 strike, which shed 8.42 lakh contracts, and 17,500 strike, which shed 8.29 lakh contracts.

The maximum Put open interest was seen at 17,000 strike, with 98.3 lakh contracts, which remains an important area to watch in the coming session.

This is followed by the 16,800 strike, comprising 76.24 lakh contracts, and the 16,900 strike, where we have 66.59 lakh contracts.

Put writing was seen at 16,700 strike, which added 17.98 lakh contracts, followed by 16,900 strike, which added 12.78 lakh contracts, and 16,800 strike, which added 10.08 lakh contracts.

We have seen Put unwinding at 17,000 strike, which shed 23.23 lakh contracts, followed by 16,000 strike, which shed 10.55 lakh contracts, and 16,400 strike, which shed 10.16 lakh contracts.

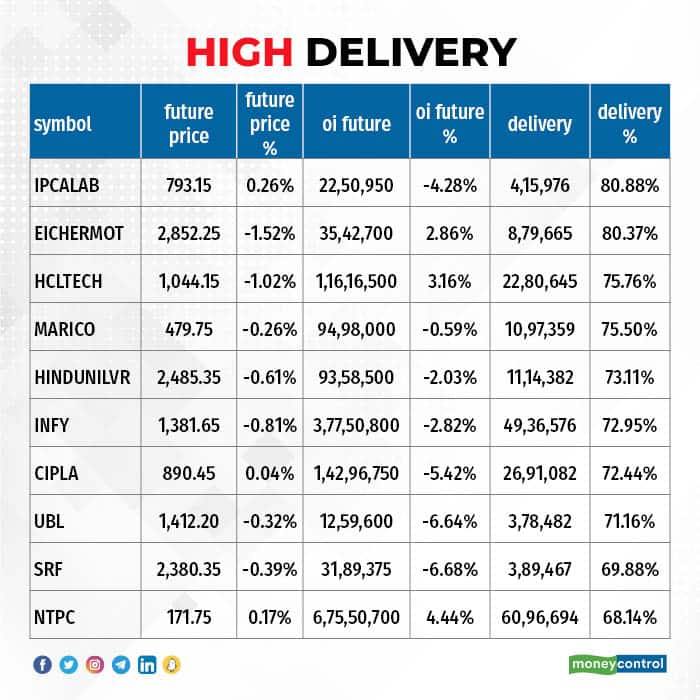

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks. The highest delivery was seen in Ipca Laboratories, Eicher Motors, HCL Technologies, Marico, and Hindustan Unilever, among others.

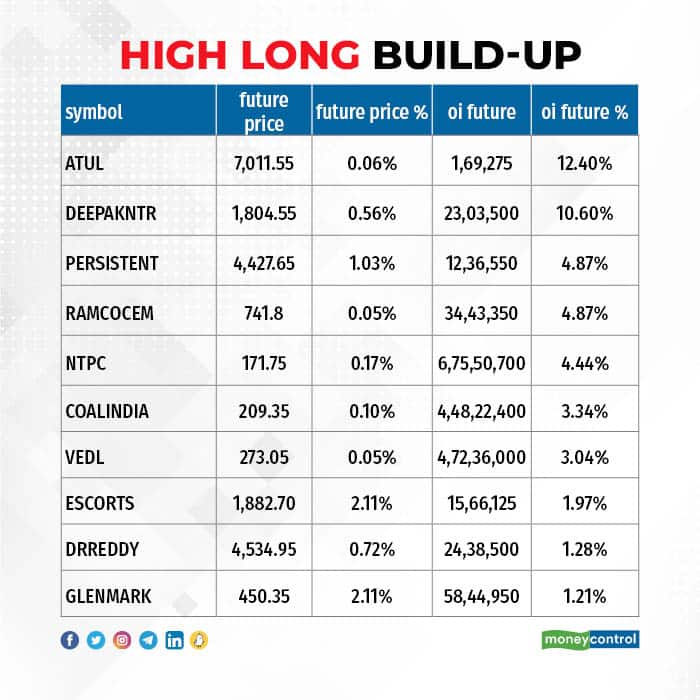

An increase in open interest (OI) and in price mostly indicates a build-up of long positions. Based on the OI percentage, we have seen 37 stocks in the list of long build-up including Atul, Deepak Nitrite, Persistent Systems, Ramco Cements, and NTPC.

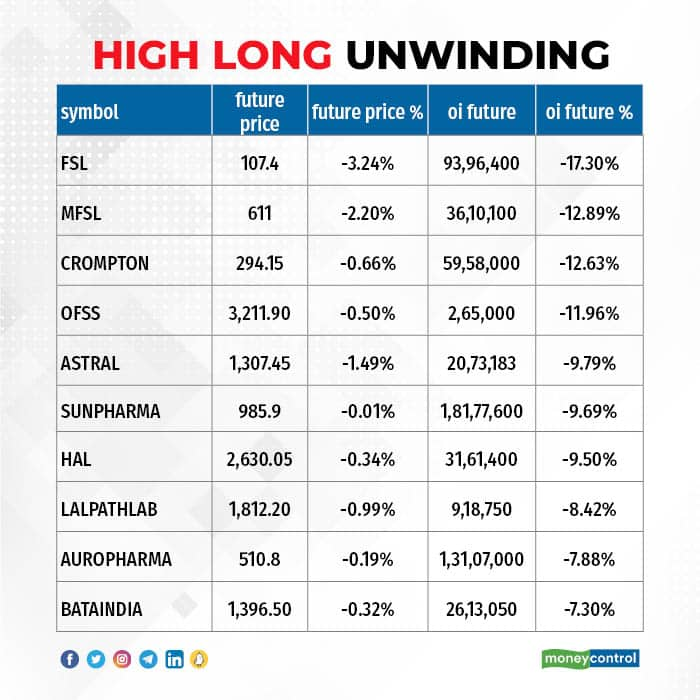

The decline in OI and a decrease in price generally indicates a long unwinding. Based on the OI percentage, 98 stocks, including Firstsource Solutions, Max Financial Services, Crompton Greaves Consumer Electricals, Oracle Financial, and Astral, witnessed a long unwinding.

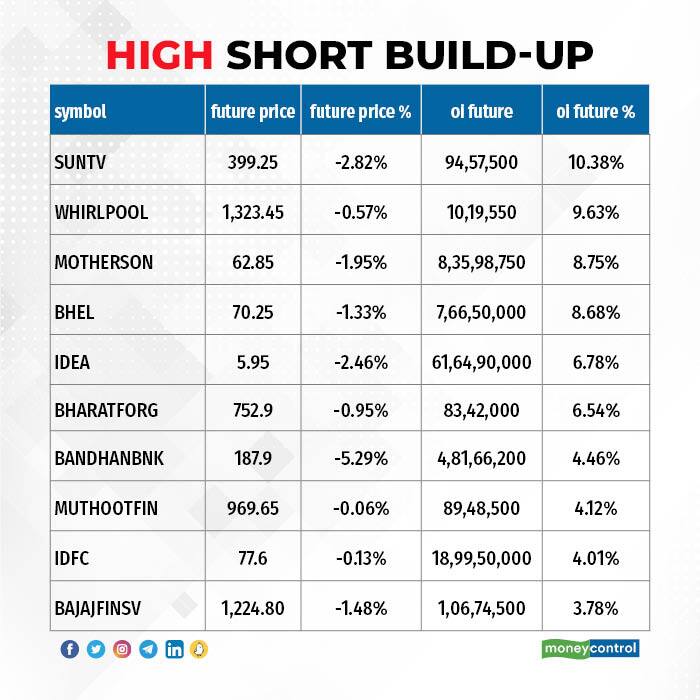

40 stocks see a short build-up

An increase in OI accompanied by a decrease in price mostly indicates a build-up of short positions. Based on the OI percentage, we have seen total 40 stocks in the list of short build-up including Sun TV Network, Whirlpool, Samvardhana Motherson International, BHEL, and Vodafone Idea.

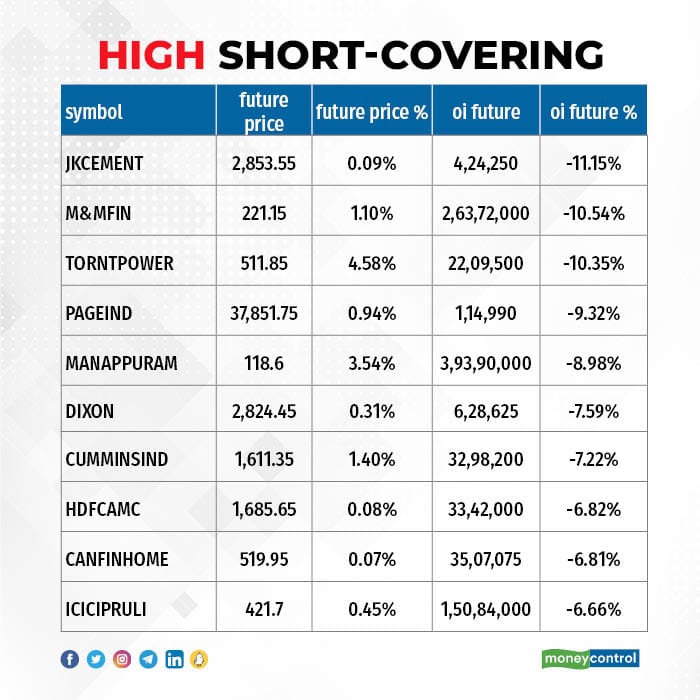

A decrease in OI along with an increase in price is an indication of short-covering. Based on the OI percentage, 42 stocks were on the short-covering list. These included JK Cement, M&M Financial Services, Torrent Power, Page Industries, and Manappuram Finance.

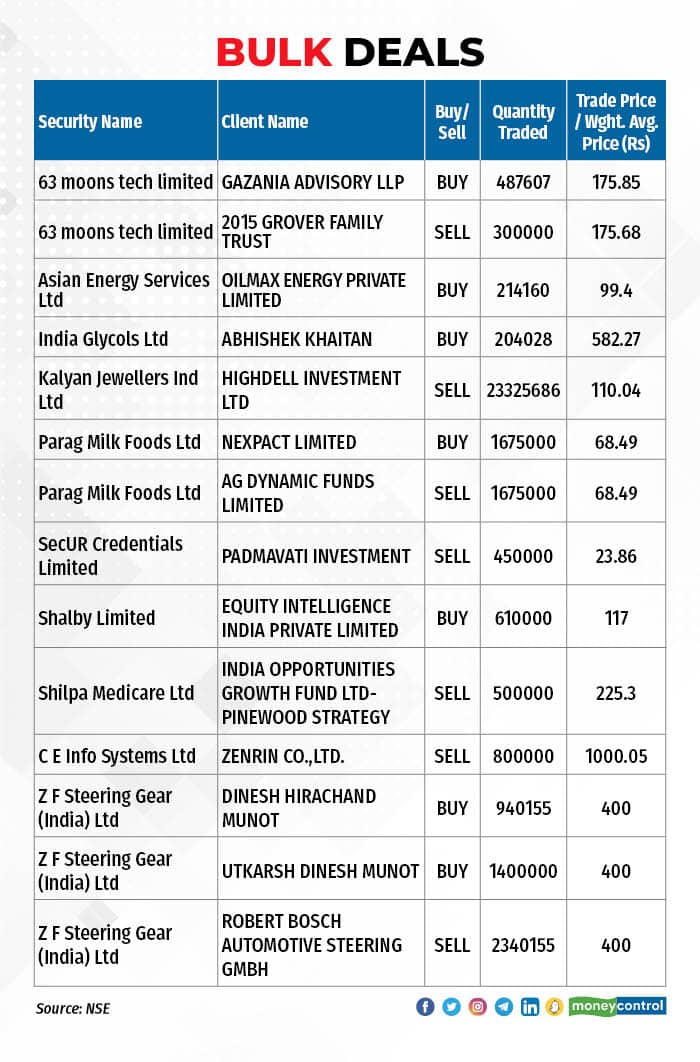

Asian Energy Services: Promoter entity Oilmax Energy has acquired additional 2.14 lakh equity shares or 0.56 percent stake in Asian Energy Services, the services provider to energy & minerals sector, at an average price of Rs 99.4 per share.

Kalyan Jewellers India: Mauritius-based Highdell Investment, owned by New York-based private equity investment firm Warburg Pincus, has sold 2.33 crore equity shares or 2.26 percent shareholding in the jewellery maker at an average price of Rs 110.04 per share, which amounted to Rs 256.67 crore.

Shalby: Ace investor Porinju Veliyath-owned Equity Intelligence India has bought 6.1 lakh shares in the multispecialty hospitals chain or 0.56 percent stake at an average price of Rs 117 per share.

Shilpa Medicare: Foreign portfolio investor India Opportunities Growth Fund Ltd - Pinewood Strategy has sold 5 lakh shares or 0.57 percent stake in the pharmaceutical firm via open market transaction, at an average price of Rs 225.3 per share.

C E Info Systems: Foreign firm Zenrin Co Ltd has sold 8 lakh shares or 1.49 percent stake in the MapmyIndia operator via open market transactions at an average price of Rs 1,000.05 per share, which amounted to Rs 80 crore.

(For more bulk deals, click here)

Investors' meetings on March 29

Metro Brands: Officials of the company will interact with Coupland Cardiff Asset Management.

Sundram Fasteners: Company's officials will interact with GIC.

SRF: Rahul Jain, President & CFO to meet institutional investors in US.

Metro Brands: Officials of the company will interact with Nuvama Institutional Equities.

Piramal Enterprises: Company's officials will interact with institutional investors.

Elin Electronics: Officials of the company will meet PhillipCapital (India).

Sundram Fasteners: Company's officials will interact with Ksema Wealth.

Fiem Industries: Officials of the company will participate in Opportunities Unlimited 4.0 Conference hosted by Monarch Networth Capital.

Dalmia Bharat: Representatives of the company - Rajiv Bansal, and Aditi Mittal - will attend investor meetings in Hong Kong organised by Kotak Securities.

Crompton Greaves Consumer Electricals: Company's officials will meet BNP Paribas, Goldman Sachs Asset Management, and DSP Mutual Fund.

Stocks in the news

Vedanta: The mining company said the board of directors has approved the fifth interim dividend of Rs 20.50 per equity share on face value of Re 1 per share for FY23, which amounted to Rs 7,621 crore. Meanwhile, Ajay Goel has resigned from the post of acting Chief Financial Officer of the company effective from April 9, to pursue career outside of the Group.

Jindal Stainless: The stainless steel manufacturing company has entered into a collaboration agreement with New Yaking Pte Ltd for the investment in development, construction and operation of a nickel pig iron (NPI) smelter facility in Halmahera Islands, Indonesia. JSL will acquire a 49 percent equity interest in nickel pig iron company for $157 million.

Zydus Lifesciences: The pharma company has received final approval for Loperamide hydrochloride capsules (USP 2 mg) from the United States Food and Drug Administration (USFDA). Loperamide hydrochloride capsule is indicated for the control and symptomatic relief of acute nonspecific diarrhea and chronic diarrhea associated with inflammatory bowel disease.

NBCC (India): The company has secured work orders worth Rs 146.39 crore from Ghani Khan Choudhary Institute of Engineering and Technology (GKCIET) Malda in West Bengal, and Small Industrial Development Bank of India (SIDBI).

GR Infraprojects: The company has secured letter of acceptance (LOA) from East Coast Railway, for construction of tunnel work & allied works of Khurda - Bolangir new rail line project. The project is worth Rs 587.59 crore.

RPP Infra Projects: The company has received a letter of acceptance for a project - repair & construction works of old buildings for reopening of old district jail at Bareilly Uttar Pradesh on EPC basis. The project worth Rs 148.08 crore is expected to be completed by October 31, 2024.

SML Isuzu: The company has decided to increase prices of trucks & buses by up to 4 percent and 6 percent respectively, with effect from April 1.

Fund Flow

Foreign institutional investors (FII) bought shares worth Rs 1,531.13 crore, whereas domestic institutional investors (DII) sold shares worth Rs 156.11 crore on March 28, National Stock Exchange's provisional data showed.

Stocks under F&O ban on NSE

The National Stock Exchange has not added any stock to its F&O ban list for March 29, the monthly expiry day for futures & options contracts. Securities banned under the F&O segment include companies where derivative contracts have crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.