New taxation rules applicable to debt funds with an equity exposure of up to 35 percent come into effect for investments made on or after April 1, 2023. That still leaves a small window open to invest in such funds and claim indexation benefits, up until March 31.

But the thing is, should you invest in a debt fund now just for the sake of indexation benefits?

Lock in yields

Towards the end of the financial year the liquidity in the financial system goes down as large corporates require funds to settle outstanding bills, pay taxes, and for other purposes. This year, the impact of the ongoing rate hike cycle is already being felt. Since May 2022, the Reserve Bank of India (RBI) has raised policy rates by 250 basis points (bps).

“Yields across maturities have gone up by 200 to 250 bps over the last one year. Bonds maturing in two to three years are attractive now. Yields are expected to trade in a narrow range for some time. Investors can capitalise on this opportunity,” says Prashant Pimple, Chief Investment Officer, Baroda BNP Paribas Mutual Fund.

The chances of further rate hikes by the RBI appear muted. Rahul Pal, CIO, Fixed Income, Mahindra Manulife Mutual Fund, is of the opinion that the markets have possibly discounted further repo rate hikes as one-year treasuries are quoting at around 7.45 to 7.5 percent.

“With domestic core inflation still remaining sticky and high, the monetary policy committee of the RBI may err on the side of caution and raise rates by another 25 bps, and thereafter pause for the lagged impact of the cumulative monetary policy actions of the past to play out,” he says.

Current high yields and the limited window for indexation benefits make debt funds a compelling proposition.

Indexation cuts your tax bill

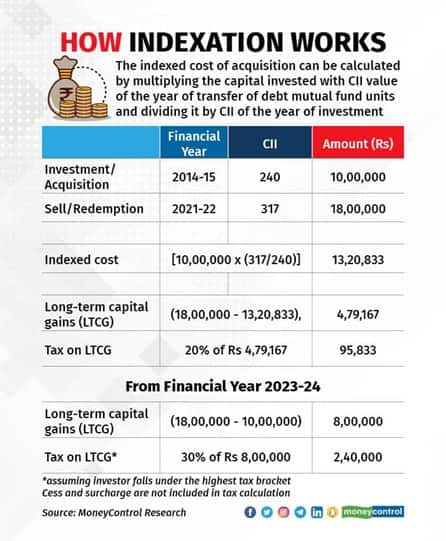

Indexation makes your gains look better by accounting for inflation. It brings down the liability of the investor by raising the cost of acquisition in line with inflation. Index values for the purpose of tax computation are announced each year. Index values for the year of acquisition and for the year of sale are considered while computing the tax liability.

A look at the table below explains the process better. So even if an investor buys a debt mutual in the last few days of the financial year, even then he can use the index value for that year. For example, if an investor buys units of a debt fund on 25 March 2018 and sells them on 5 April 2021, then technically his investment period is spread across five financial years (FY2017-2018 to FY2021-2022), though in reality he has remained invested for slightly more than three years. This helps in reducing the tax burden and many investors take advantage of tthis computation methodology, which is perfectly legal.

Should you invest?

Should you invest?

Debt funds look appealing currently, especially given that the end of indexation benefits is nigh. But don’t just pick any debt fund that pops up in front of you. Choose wisely.

The more conservative lot should look at target funds with a residual maturity of three to four years. These look good as such schemes generally invest in line with an underlying debt index which usually comprises good quality bonds – government securities, state development loans, or bonds issued by public sector enterprises which mature around a particular date. This ensures that there is very low credit risk, and investors capable of holding the units till maturity get a fair idea of the kind of returns they can expect from the scheme.

Though experts are recommending short to medium duration products for the regular investor, savvy investors are eyeing long duration funds as well.

Since these schemes buy long duration bonds, they may see intermittent marked-to- market losses if yields continue to go up. Hence, investors with an appetite for risk and a fairly long-term view should consider such funds.

Akshar Shah, Founder and CEO, Fixed, an online platform specialising in fixed income investments, says, “Yields available on long-term bonds are attractive. Investors comfortable holding on to their investments should consider long-duration funds to benefit from the indexation benefit.”

He recommends Bharat Bond 2031 ETF and Bharat Bond 2032 ETF. “If held to maturity, the yield for these funds is around 7.6 percent pre-tax today,” he adds.

While many debt funds will cease to offer the indexation benefit starting 1 April 2023, do not randomly cut cheques just to avail of tax benefits. This is especially true in case of high-risk investments such as funds of funds investing in overseas stocks.

Invest if and only if your financial goals, risk profile, and future cash-flow needs permit you to do so. Whichever investment you prefer, move quickly. The units need to be allotted on or before 31 March 2023, failing which the purchase would be considered to have been made in the next financial year.