personal-finance

What is risk-based pricing of a home loan?

Mar 14, 06:03

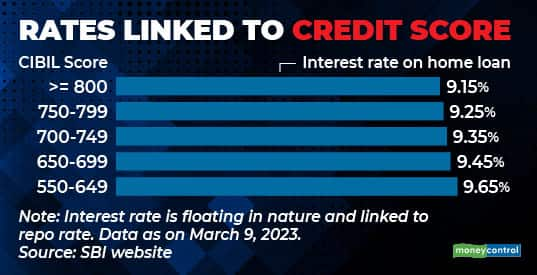

When you take a home loan, you don't get to borrow at the advertised or the rack rate. The bank also looks at your credit score. Depending on how high or low it is, it then fixes a premium, which is over and above the rack home rate. This is called risk-based pricing. For instance, the borrowers with low credit scores (less than 700) are required to pay a higher rate on a home loan and borrowers with high credit scores (over 800) are rewarded by banks with lower interest rates. Risk based pricing has been adopted by Bank of India, ICICI Bank and SBI among others.